Making a Planned Gift

A planned gift is a contribution that is arranged in the present and allocated at a future date. Commonly donated through a will or trust, planned gifts are most often granted once the donor has passed away.

What a Planned Gift Will Enable Us To Do

A planned gift will enable the St. Paul Center to better plan for the future and more effectively share the power of God’s Word with millions of Catholics through our website, books, Bible studies, and other resources.

The Benefits of a Planned Gift

With an estate plan you can be a good steward of the gifts God has given you. The St. Paul Center can help you by combining your charitable interests with effective planning. Your contributions will make it possible for us to build and plan for the future, to advance our impact with new Journey Through Scripture studies, new books from Emmaus Road Publishing and Emmaus Academic, and so much more.

How Making a Planned Gift Helps You

A planned gift can help to secure your legacy and make an impact that will last more than a lifetime. It can lessen the tax burden on your appreciated assets and reduce the estate tax your beneficiaries will have to pay.

Learn More

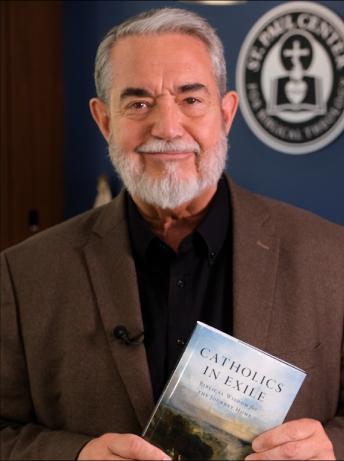

- Contact Kenneth Baldwin, Executive Director of the St. Paul Center at 740-264-9535 ext. 16 or kenbaldwin@stpaulcenter.com for additional information on making a planned gift or to discuss different options for including the St. Paul Center in your will or estate plan.

- Seek the advice of your financial or legal advisor.

- If you decide to name the St. Paul Center in your will or estate plan, we thank you for your generosity. Please be sure to use the Center’s legal name and federal tax identification number.

Legal Name: The St. Paul Center for Biblical Theology

Address: 1380 University Blvd. – Steubenville, OH 43952

Federal Tax ID Number: 75-2980638 - Fill out and return the Sts. Peter & Paul Society Membership Acceptance Form.

The information on this page is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. References to estate and income taxes include federal taxes only. State income/estate taxes or state law may impact your results.

“Why I Gave”

“I’ve been involved with the St. Paul Center since it was founded by Dr. Hahn over twenty years ago. I believe there is a great need for Catholics to better understand the Bible. The Center’s mission of helping the laity read Sacred Scripture from the heart of the Church and assisting priests in becoming biblically fluent is something I’m passionate about. I want to leave a legacy gift that will impact the Church for generations. Naming the St. Paul Center as one of the charitable beneficiaries of my will enables me to serve and support our priests as well as to help inspire fallen away Catholics to come back home.”

Diane

Longtime St. Paul Center supporter

Fr. John Ollivier

On December 27, 2002, Fr. John Ollivier wrote these words to Dr. Scott Hahn: “Sincerest thanks for the gift of the St. Paul Center. I consider it an honor to support the great work you are doing. I can think of no cause more worthy.”

Just two months later, on February 19, 2003, Fr. Ollivier passed away. He had bequeathed a percentage of his estate to the St. Paul Center.